web3.0

web3.0

What is the Jupiter platform? What is the relationship with Solana? One article will give you a complete analysis

What is the Jupiter platform? What is the relationship with Solana? One article will give you a complete analysis

What is the Jupiter platform? What is the relationship with Solana? One article will give you a complete analysis

Mar 03, 2025 pm 07:36 PMJupiter: Leading DEX aggregator in the Solana ecosystem

This article will explore Jupiter, the leading decentralized exchange (DEX) aggregator in the Solana ecosystem. Jupiter integrates the liquidity of multiple DEXs to provide users with the best price, lowest slippage and efficient trading experience.

Jupiter's core advantages:

- Price advantages: By aggregating multiple DEXs, ensure that users get the best transaction price.

- Speed ??advantage: Use Solana's high TPS to achieve extremely low transaction delays.

- Cost Advantage: Solana's Gas costs are cheaper than other blockchains.

Jupiter Main functions:

1. DEX aggregation: Jupiter integrates the liquidity of multiple DEXs such as Raydium, Orca, Serum, etc., providing users with: the best transaction price, the lowest slippage and transaction cost, as well as fast transaction execution. Its parallel processing architecture is significantly better than the aggregators on other EVM chains.

2. Swap trading and limit order:

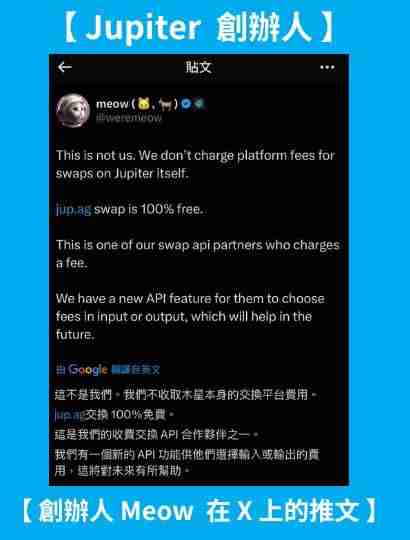

- Jupiter Swap: Users can easily exchange tokens, and the system automatically selects the optimal trading path. The platform itself does not charge additional fees, only DEX transaction fees and Solana network fees are required. It should be noted that some partners using the Jupiter API may charge additional fees.

- Jupiter Limit: Users can set price orders and automatically execute when the market price reaches the target to ensure that the transaction is completed at an ideal price. The handling fee is only 0.1%.

3. DCA & VA: On-chain fixed investment and value average method:

Jupiter provides two intelligent investment tools: DCA (regular fixed investment) and VA (value average method), helping users reduce market volatility risks and achieve long-term stable investment.

4. Perps Perpetual Contract:

Jupiter provides perpetual contracts such as SOL, ETH, WBTC, etc., with a leverage range of 1.1x – 100x, and supports the use of Solana intra-ecological tokens as margin.

$JUP Token Economics:

- Token name: Jupiter ($JUP)

- Total supply: 7 billion pieces (30% cut)

- Main uses: Community governance, voting decision-making, Launchpad investment and platform handling fee discounts.

Token allocation: In August 2024, the Jupiter community cut the token supply by 30% through a proposal to reduce future selling pressure and enhance market confidence.

Future development of Jupiter: Jupiter will continue to improve DEX aggregation technology, expand cross-chain transactions, and strengthen DAO governance. The ultimate goal is to become the world's leading DeFi transaction infrastructure.

Conclusion:

Jupiter has become the leading DEX aggregator on Solana with its powerful features and the advantages of the Solana ecosystem, and has great development potential. The maturity of $JUP tokens and the development of LFG Launchpad will further promote the prosperity of the Jupiter and Solana DeFi ecosystems.

The above is the detailed content of What is the Jupiter platform? What is the relationship with Solana? One article will give you a complete analysis. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

A must-read for beginners: How to buy Ethereum? Teach you step by step to get started with ETH investment

Jul 09, 2025 pm 08:06 PM

A must-read for beginners: How to buy Ethereum? Teach you step by step to get started with ETH investment

Jul 09, 2025 pm 08:06 PM

As one of the mainstream digital assets, Ethereum (ETH) has attracted a lot of investors' attention. For beginners, how to buy Ethereum safely and quickly is the key to taking the first step in investment. This article will explain step by step the entire process from registering an account to successfully purchasing ETH, helping readers easily get started with digital asset investment.

The three giants in the currency circle compete! Which one is more suitable for long-term holding, Bitcoin, Ethereum, or Dogecoin?

Jul 09, 2025 pm 08:12 PM

The three giants in the currency circle compete! Which one is more suitable for long-term holding, Bitcoin, Ethereum, or Dogecoin?

Jul 09, 2025 pm 08:12 PM

As the digital asset market gradually matures, Bitcoin, Ethereum and Dogecoin are called the "three giants in the currency circle", attracting the attention of a large number of investors. This article will analyze their technical basis, market position, community activity and long-term potential, so as to help users understand which one is more suitable for long-term holding.

How to choose Bitcoin, Ethereum, Dogecoin? The three major currencies that retail investors must understand before investing

Jul 09, 2025 pm 08:27 PM

How to choose Bitcoin, Ethereum, Dogecoin? The three major currencies that retail investors must understand before investing

Jul 09, 2025 pm 08:27 PM

In the virtual asset market, Bitcoin, Ethereum and Dogecoin are the three most common mainstream currencies, and many new retail investors are often confused when faced with these three. This article will compare and analyze technical characteristics, application scenarios, market performance, development ecology and community support, etc., to help investors understand the differences between these three currencies more clearly and make more appropriate choices.

The popularity of the currency circle has returned, why do smart people have begun to quietly increase their positions? Look at the trend from the on-chain data and grasp the next round of wealth password!

Jul 09, 2025 pm 08:30 PM

The popularity of the currency circle has returned, why do smart people have begun to quietly increase their positions? Look at the trend from the on-chain data and grasp the next round of wealth password!

Jul 09, 2025 pm 08:30 PM

As the market conditions pick up, more and more smart investors have begun to quietly increase their positions in the currency circle. Many people are wondering what makes them take decisively when most people wait and see? This article will analyze current trends through on-chain data to help readers understand the logic of smart funds, so as to better grasp the next round of potential wealth growth opportunities.

No longer blindly trading coins! Understand the true value of Bitcoin, Ethereum, Dogecoin in one article

Jul 09, 2025 pm 08:15 PM

No longer blindly trading coins! Understand the true value of Bitcoin, Ethereum, Dogecoin in one article

Jul 09, 2025 pm 08:15 PM

?Many people are easily influenced by market sentiment in digital currency investment, blindly following the trend but not understanding the value of the currency itself. This article will compare and analyze the core mechanisms and values ??of the three mainstream currencies, Bitcoin, Ethereum, and Dogecoin, to help readers establish rational cognition and avoid being misled by short-term fluctuations.

Crypto Asset Allocation Guide: How to avoid pitfalls and make steady profits in 2025? A low-risk strategy in high volatility, suitable for long-term holders!

Jul 09, 2025 pm 08:36 PM

Crypto Asset Allocation Guide: How to avoid pitfalls and make steady profits in 2025? A low-risk strategy in high volatility, suitable for long-term holders!

Jul 09, 2025 pm 08:36 PM

With the continuous evolution of the crypto market, investors face not only the temptation of high returns, but also the challenge of high risks in 2025. Especially in high volatility market conditions, how to avoid traps and achieve stable returns has become the core issue that long-term holders pay attention to. This article will give a detailed explanation of asset allocation strategies and recommend several low-risk investment methods that are suitable for long-term holding.

Still struggling with which coin to buy? Bitcoin, Ethereum, Dogecoin are suitable for different types of investors!

Jul 09, 2025 pm 08:09 PM

Still struggling with which coin to buy? Bitcoin, Ethereum, Dogecoin are suitable for different types of investors!

Jul 09, 2025 pm 08:09 PM

Faced with the many mainstream digital assets on the market, many novice users often don’t know how to choose. Bitcoin, Ethereum and Dogecoin are three representative digital currencies, each with their own characteristics and suitable for the people. This article will help users clearly determine which currency is more suitable for their investment strategy based on currency characteristics, development potential and user comments.

What is the most promising virtual currency in 2025? A comprehensive analysis of the investment prospects of Bitcoin, Ethereum, Dogecoin

Jul 09, 2025 pm 08:18 PM

What is the most promising virtual currency in 2025? A comprehensive analysis of the investment prospects of Bitcoin, Ethereum, Dogecoin

Jul 09, 2025 pm 08:18 PM

As blockchain technology continues to mature, the virtual currency market remains highly concerned in 2025. Bitcoin, Ethereum and Dogecoin are mainstream digital assets and are attracting investors' attention. This article will analyze the investment potential of the three currencies from four aspects: project development, community activity, practical application and market trends, and help users compare and make more rational judgments.