web3.0

web3.0

Survival Guide for Bear Market: Three Cryptocurrency Profit Strategies That Does Not Rely on Markets

Survival Guide for Bear Market: Three Cryptocurrency Profit Strategies That Does Not Rely on Markets

Survival Guide for Bear Market: Three Cryptocurrency Profit Strategies That Does Not Rely on Markets

Mar 05, 2025 am 08:33 AMOriginal text: The DeFi Investor

Compiled by Yuliya, PANews

Despite the recent sluggish performance of the cryptocurrency market, the market still has profit opportunities that do not rely on the rise in token prices. In fact, in addition to traditional traders and investors, many participants have achieved considerable returns in this area through other channels. This article will conduct in-depth analysis of three profit models that do not rely on market trends from the technical and strategic levels.

Despite the recent sluggish performance of the cryptocurrency market, the market still has profit opportunities that do not rely on the rise in token prices. In fact, in addition to traditional traders and investors, many participants have achieved considerable returns in this area through other channels. This article will conduct in-depth analysis of three profit models that do not rely on market trends from the technical and strategic levels.

1. Airdrop and Income Farm

In the current DeFi ecosystem, the liquidity mining and airdrop mechanism with leading assets such as BTC, ETH, and SOL as the core is becoming increasingly perfect. Taking the Pendle protocol as an example, its smart contract supports stablecoin asset locking to obtain a fixed annualized rate of return (APY) of 19%, and a fixed annualized return of 12% for BTC assets. By optimizing strategy combination and capital utilization efficiency, professional operators can achieve 50-80% annualized profits of stablecoin.

2. Shorting arbitrage for high FDV new coins

2. Shorting arbitrage for high FDV new coins

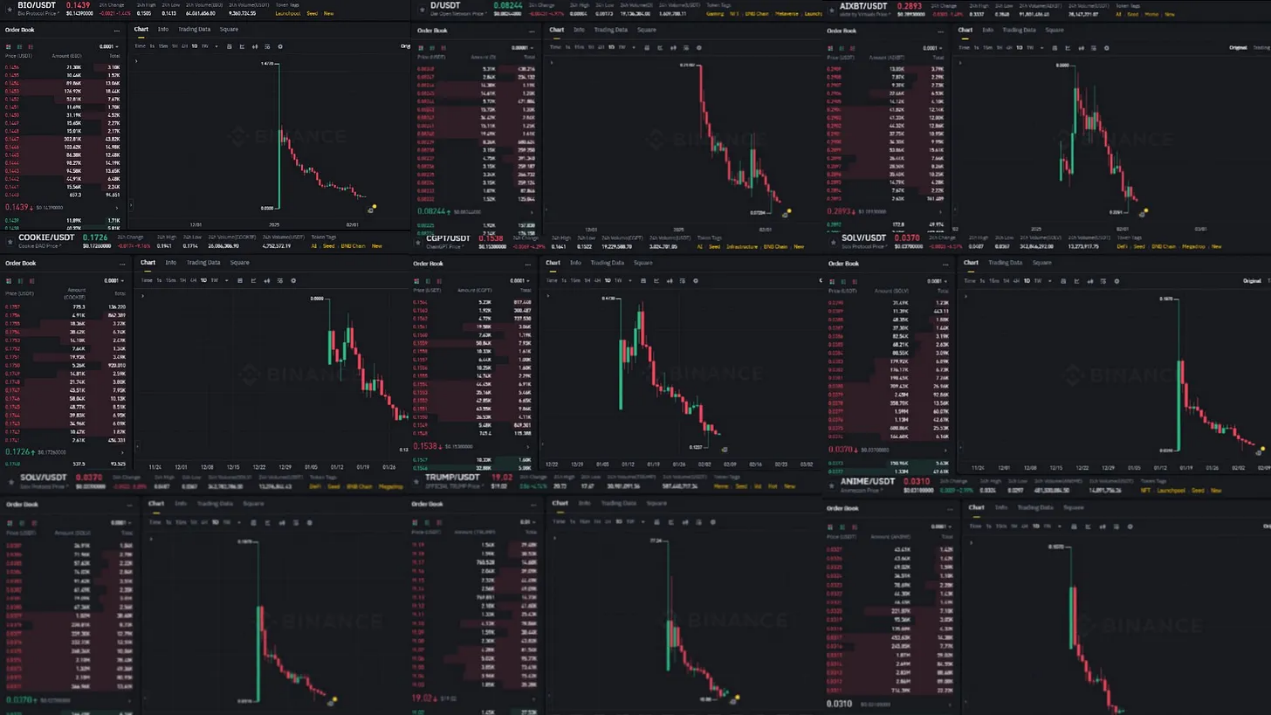

Through technical analysis of the newly launched tokens on Binance Exchange, it is shown that most tokens show a significant downward trend after TGE. This market phenomenon mainly stems from two core factors:

幣安近期上架的新代幣Tokens are severely diversified: On-chain data shows that tens of thousands of tokens are issued every dayValue system imbalance: Project parties tend to cash out early investors through high valuation model

- As the market says, "There are opportunities in chaos." This market inefficiency provides professional traders with significant short selling opportunities. The derivatives trading platform represented by Hyperliquid provides an effective trading channel for short-selling strategies by quickly launching a perpetual contract for the new currency. However, it should be noted that considering the high volatility characteristics of newly issued tokens, it is recommended to adopt a low leverage strategy to optimize the risk-to-return ratio and accumulate strategic experience through small-scale experiments.

- 3. Capital rate arbitrage (Delta neutral strategy)

When the capital rate is positive, the long direction needs to pay the fee to the short direction;

When the capital rate is negative, the short position pays the long.

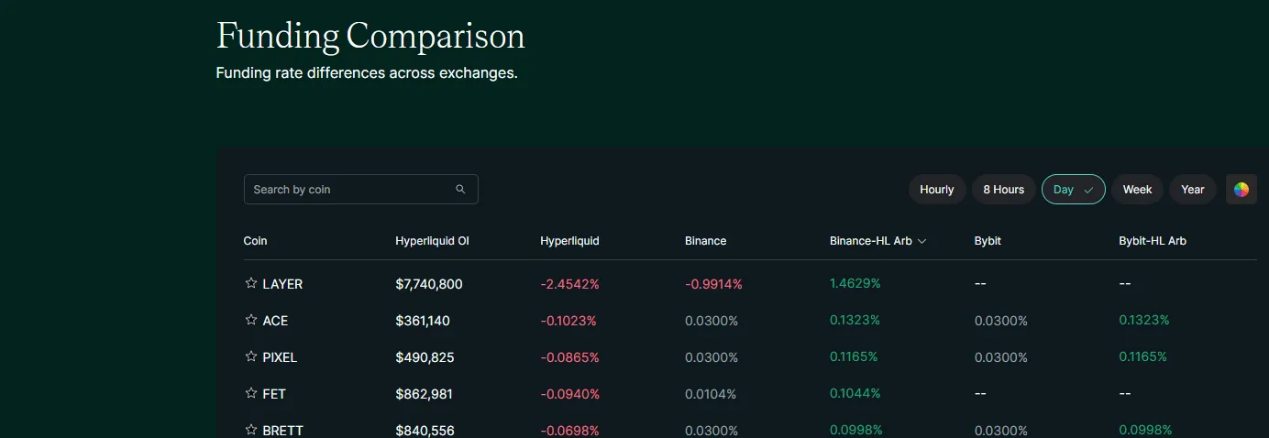

- Professional traders can capture the fund rate spread by building a Delta neutral portfolio. At the specific operational level, when a significant positive capital rate is observed, a BTC spot long and a contract short position of $1,000 can be established at the same time (the capital rate can be monitored through the Coinglass platform) and a stable return can be obtained through a market neutral strategy.

At present, Ethena and Resolv and other agreements have developed automated fund rate arbitrage systems to provide users with passive benefits. However, by manually operating multi-variety arbitrage strategies, although time-consuming, they may still gain higher returns. Investors can use the "Funding Comparison" functional section of the Hyperliquid platform to look for arbitrage opportunities.

Summary

Even during the market downturn, there are still many opportunities in the cryptocurrency sector. Contrary to general perception, there are still many invalid phenomena in the crypto market, which provides a rich profit margin for arbitrageurs. It is recommended that every participant should find a specific field that they are good at and can make profits, and continue to improve, and strive to become an expert in this field.

The above is the detailed content of Survival Guide for Bear Market: Three Cryptocurrency Profit Strategies That Does Not Rely on Markets. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What are the real-time cryptocurrency market websites? Which websites can view the currency market for free?

Jul 17, 2025 pm 09:27 PM

What are the real-time cryptocurrency market websites? Which websites can view the currency market for free?

Jul 17, 2025 pm 09:27 PM

In the currency circle, real-time understanding of currency price changes is crucial to investment decisions. Below are several free and reliable cryptocurrency real-time market websites, suitable for beginners and senior players.

Bitcoin price quote viewing software app to view free quote websites in real time

Jul 17, 2025 pm 06:45 PM

Bitcoin price quote viewing software app to view free quote websites in real time

Jul 17, 2025 pm 06:45 PM

This article recommends 6 mainstream Bitcoin price and market viewing tools. 1. Binance provides real-time and accurate data and rich trading functions, suitable for all kinds of users; 2. OKX has a friendly interface and perfect charts, suitable for technical analysis users; 3. Huobi (HTX) data is stable and reliable, and simple and intuitive; 4. Gate.io has rich currency, suitable for users who track a large number of altcoins at the same time; 5. TradingView aggregates multi-exchange data, with powerful chart and technical analysis functions; 6. CoinMarketCap provides overall market performance data, suitable for understanding the macro market of Bitcoin.

Coinan Exchange Exchange official website Chinese App download. Ranked the top ten.cc

Jul 17, 2025 pm 07:00 PM

Coinan Exchange Exchange official website Chinese App download. Ranked the top ten.cc

Jul 17, 2025 pm 07:00 PM

Binance is an internationally renowned blockchain digital asset trading platform founded by Canadian Chinese engineer Zhao Changpeng, which provides diversified services such as digital currency trading, blockchain education, and project incubation.

How to download Huawei mobile phone Ouyi Android version Ouyi security portal

Jul 17, 2025 pm 07:03 PM

How to download Huawei mobile phone Ouyi Android version Ouyi security portal

Jul 17, 2025 pm 07:03 PM

OKX is a world-renowned digital asset trading platform, providing a safe and stable trading environment and diversified asset management solutions. The platform supports currency trading, derivative trading and financial products to meet the needs of different users. Huawei mobile phone users can download the Android version of the application by visiting the official website, and must ensure the network stability and allow the installation of external sources of applications. After installation, it is recommended to complete identity authentication and security settings, such as binding the mobile phone number and enabling two-factor verification. Core functions include comprehensive trading services, top-notch security protection and convenient asset management.

How to set stop loss and take profit? Practical skills for risk control of cryptocurrency transactions

Jul 17, 2025 pm 07:09 PM

How to set stop loss and take profit? Practical skills for risk control of cryptocurrency transactions

Jul 17, 2025 pm 07:09 PM

In cryptocurrency trading, stop loss and take profit are the core tools of risk control. 1. Stop loss is used to automatically sell when the price falls to the preset point to prevent the loss from expanding; 2. Take-profit is used to automatically sell when the price rises to the target point and lock in profits; 3. The stop loss can be set using the technical support level method, the fixed percentage method or the volatility reference method; 4. Setting the stop profit can be based on the risk-return ratio method or the key resistance level method; 5. Advanced skills include moving stop loss and batch take-profit to dynamically protect profits and balance risks, thereby achieving long-term and stable trading performance.

OEX official website entrance OEX (Ouyi) platform official registration entrance

Jul 17, 2025 pm 08:42 PM

OEX official website entrance OEX (Ouyi) platform official registration entrance

Jul 17, 2025 pm 08:42 PM

The OEX official website entrance is the primary channel for users to enter the OEX (OEX) platform. The platform is known for its safety, efficiency and convenience, and provides currency trading, contract trading, financial management services, etc. 1. Visit the official website; 2. Click "Register" to fill in your mobile phone number or email address; 3. Set your password and verify; 4. Log in after successful registration. The platform's advantages include high security, simple operation, rich currency, and global service. It also provides beginner's guidance and teaching modules, suitable for all types of investors.

Where can I see the Bitcoin market trend? Bitcoin market website recommendation

Jul 17, 2025 pm 09:21 PM

Where can I see the Bitcoin market trend? Bitcoin market website recommendation

Jul 17, 2025 pm 09:21 PM

Understanding Bitcoin’s real-time price trends is crucial to participating in the cryptocurrency market. This will not only help you make smarter investment decisions, but will also allow you to seize market opportunities in a timely manner and avoid potential risks. By analyzing historical data and current trends, you can have a preliminary judgment on the future price direction. This article will recommend some commonly used market analysis websites for you. We will focus on how to use these websites for market analysis to help you better understand the reasons and trends of Bitcoin price fluctuations.

What are the cryptocurrency market websites? Recommended virtual currency market websites

Jul 17, 2025 pm 09:30 PM

What are the cryptocurrency market websites? Recommended virtual currency market websites

Jul 17, 2025 pm 09:30 PM

In the ever-changing virtual currency market, timely and accurate market data is crucial. The free market website provides investors with a convenient way to understand key information such as price fluctuations, trading volume, and market value changes of various digital assets in real time. These platforms usually aggregate data from multiple exchanges, and users can get a comprehensive market overview without switching between exchanges, which greatly reduces the threshold for ordinary investors to obtain information.