web3.0

web3.0

How to operate contract segmentation entrustment? Contract segmented commission operation tutorial

How to operate contract segmentation entrustment? Contract segmented commission operation tutorial

How to operate contract segmentation entrustment? Contract segmented commission operation tutorial

Mar 05, 2025 pm 04:06 PMContract segmentation commission: a strategic guide to efficiently execute large-scale contract transactions

Contract segmentation entrustment refers to a strategy of splitting a large entrustment order into multiple smaller orders and gradually completing transaction execution. This method is especially suitable for large-scale transactions or large market fluctuations, effectively reducing price shocks and slippages, and optimizing transaction results. This article will introduce in detail the operation methods of contract segmentation delegation to help you achieve better execution results in contract transactions.

Ouyi Exchange contract segment entrustment steps:

The following steps demonstrate the operation process of contract segmented entrustment using Ouyi Exchange as an example:

- Login and select a trading pair: Download and log in to the Ouyi App, go to the "Trading" page, select the "Contract" trading mode, and select the contract trading pair you want to trade (such as BTC/USDT).

- Select a segmented delegation type: In the delegation type, select "Limit Delegation" or "Market Delegation", and then select the "Segment Delegation" option.

- Set segmented entrustment parameters: Set key parameters, including the lowest price, highest price, order quantity, quantity per order, and target average entry price.

- Confirm and submit an order: Click "Open Long" or "Open Short", the system will pop up the order confirmation window. Please carefully check the information and click "Confirm" to submit the order.

- View Order Status: Unsold orders can be viewed in the "Order Order", and completed orders can be viewed in the "Position".

Order modification and cancellation:

Unfinished segmented orders can be modified or cancelled. However, the orders that have been sold will not be modified.

Advantages of segmented commissioning:

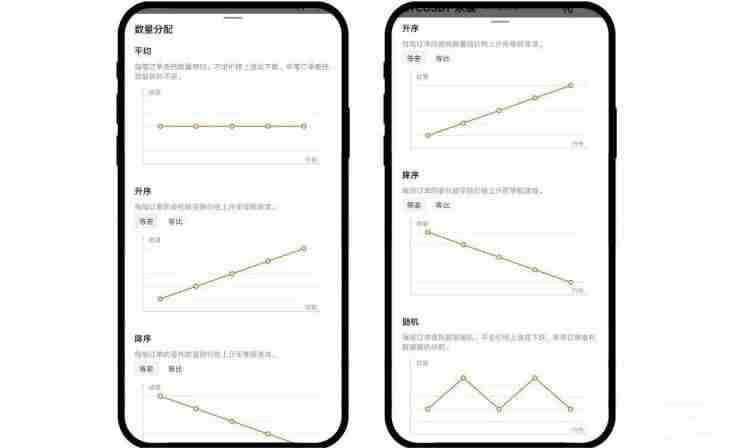

Segmental commissioning splits large orders into multiple small orders, spreads in and out, effectively reducing the impact on the market and reducing the risk of price fluctuations caused by large orders. It provides a variety of delegation modes (such as equalization, ascending, descending, and random) to meet different transaction needs and improve transaction efficiency.

Segmented commission case:

Suppose you want to buy 1000 BTC, placing an order at one time may lead to a price increase. Using segmented orders, you can split your order into 10 small orders of 100 BTC, execute them in batches, reduce the risk of price volatility and obtain a more ideal average buy price.

Risk warning:

Although segmented entrustment can optimize transactions, there are still market risks. Before using it, be sure to fully understand the contract trading rules and risks and operate with caution.

The above is the detailed content of How to operate contract segmentation entrustment? Contract segmented commission operation tutorial. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Is PEPE coins worth buying? Which PEPE coins will surge in 2025

Jul 11, 2025 pm 10:36 PM

Is PEPE coins worth buying? Which PEPE coins will surge in 2025

Jul 11, 2025 pm 10:36 PM

Whether PEPE coins are worth buying depends on the project's technical background, market performance and ecological construction, and are suitable for investors with strong risk tolerance. 1.PEPE coins are community-driven, with high activity but high volatility; 2. Team technical support and innovation determine long-term development; 3. Trading volume and liquidity affect market experience. PEPE coins that may soar in 2025 include: 1. Projects with rich ecology and clear application scenarios; 2. Projects with hot topics such as NFT and DeFi and strong innovation; 3. Projects with active community and complete governance mechanisms; 4. Projects with cross-chain support and multi-platform listing. Rational judgment and risk control are the key to successful investment.

What are the mechanisms for the impact of the BTC halving event on the currency price?

Jul 11, 2025 pm 09:45 PM

What are the mechanisms for the impact of the BTC halving event on the currency price?

Jul 11, 2025 pm 09:45 PM

Bitcoin halving affects the price of currency through four aspects: enhancing scarcity, pushing up production costs, stimulating market psychological expectations and changing supply and demand relationships; 1. Enhanced scarcity: halving reduces the supply of new currency and increases the value of scarcity; 2. Increased production costs: miners' income decreases, and higher coin prices need to maintain operation; 3. Market psychological expectations: Bull market expectations are formed before halving, attracting capital inflows; 4. Change in supply and demand relationship: When demand is stable or growing, supply and demand push up prices.

ETH latest price APP_ETH real-time price update platform entrance

Jul 11, 2025 pm 10:33 PM

ETH latest price APP_ETH real-time price update platform entrance

Jul 11, 2025 pm 10:33 PM

To view the latest price and real-time updates of ETH, you can use the following mainstream platforms: 1. Binance provides real-time price, historical data and market rankings; 2. OKX supports multi-language interface and displays trading volume and market depth; 3. Huobi provides transaction data such as K-line charts and depth charts; 4. Coinbase displays price trends and historical data; 5. Gate.io interface is friendly and suitable for beginners. It is recommended to obtain accurate and secure information through official and well-known platforms to assist investment decisions.

Is NALA coins worth buying? Which cryptocurrencies are worth buying in July

Jul 11, 2025 pm 10:30 PM

Is NALA coins worth buying? Which cryptocurrencies are worth buying in July

Jul 11, 2025 pm 10:30 PM

Whether NALA coins are worth buying requires a comprehensive evaluation of project technology, team strength and market performance. It is suitable for investors with strong risk tolerance in the short term. At the same time, in July, we recommend paying attention to mainstream coins such as Bitcoin, Ethereum and currencies with complete ecosystems with innovative applications. ①NALA currency has strong community support and technological innovation, and the project ecology is gradually improved; ② There may be large fluctuations in the short term, which is suitable for investors with certain risk tolerance; ③ The project team continues to promote the implementation of application scenarios, which is conducive to the stability and growth of currency values; ④ It is necessary to pay attention to the overall market environment and the performance of competitive currency, and formulate investment plans rationally; ⑤ In July, we recommend buying mainstream coins such as Bitcoin (BTC), Ethereum (ETH) and other currencies with mature market foundation and high security;

Cardano's smart contract evolution: The impact of Alonzo upgrades on 2025

Jul 10, 2025 pm 07:36 PM

Cardano's smart contract evolution: The impact of Alonzo upgrades on 2025

Jul 10, 2025 pm 07:36 PM

Cardano's Alonzo hard fork upgrade has successfully transformed Cardano from a value transfer network to a fully functional smart contract platform by introducing the Plutus smart contract platform. 1. Plutus is based on Haskell language, with powerful functionality, enhanced security and predictable cost model; 2. After the upgrade, dApps deployment is accelerated, the developer community is expanded, and the DeFi and NFT ecosystems are developing rapidly; 3. Looking ahead to 2025, the Cardano ecosystem will be more mature and diverse. Combined with the improvement of scalability in the Basho era, the enhancement of cross-chain interoperability, the evolution of decentralized governance in the Voltaire era, and the promotion of mainstream adoption by enterprise-level applications, Cardano has

What are the PEPE coins? PEPE series coins analysis

Jul 11, 2025 pm 10:27 PM

What are the PEPE coins? PEPE series coins analysis

Jul 11, 2025 pm 10:27 PM

PEPE coins include PEPE, PEPECASH, PEPE DAO Token and PEPE NFT Token. 1. PEPE is an original currency, based on emoticon culture, emphasizing community-driven; 2. PEPECASH is used for social payment and content incentives; 3. PEPE DAO Token supports community governance; 4. PEPE NFT Token combines digital art. These coins rely on active communities, but their prices fluctuate greatly and are susceptible to social media. Some projects integrate DeFi and NFT concepts and have innovative potential. When investing, they should comprehensively evaluate the project background and risk tolerance.

What are the mainstream public chains of cryptocurrencies? The top ten rankings of cryptocurrency mainstream public chains in 2025

Jul 10, 2025 pm 08:21 PM

What are the mainstream public chains of cryptocurrencies? The top ten rankings of cryptocurrency mainstream public chains in 2025

Jul 10, 2025 pm 08:21 PM

The pattern in the public chain field shows a trend of "one super, many strong ones, and a hundred flowers blooming". Ethereum is still leading with its ecological moat, while Solana, Avalanche and others are challenging performance. Meanwhile, Polkadot, Cosmos, which focuses on interoperability, and Chainlink, which is a critical infrastructure, form a future picture of multiple chains coexisting. For users and developers, choosing which platform is no longer a single choice, but requires a trade-off between performance, cost, security and ecological maturity based on specific needs.

BTC price trend analysis: What indicators should be taken for the rise and fall in the future (2026-2030)?

Jul 10, 2025 pm 09:06 PM

BTC price trend analysis: What indicators should be taken for the rise and fall in the future (2026-2030)?

Jul 10, 2025 pm 09:06 PM

Bitcoin’s long-term price trend between 2026 and 2030 will be mainly affected by four core factors. 1. Global macro liquidity, especially Fed interest rate policy, inflation data and economic growth expectations, a loose environment is usually beneficial to BTC; 2. The reduction in supply and market expectations brought about by the halving cycle in 2028 may drive price increases; 3. The clarification of the regulatory framework, especially the introduction of compliance paths and approval of financial products in major economies, is the basis of a long-term bull market; 4. The depth and breadth of institutional adoption, including corporate asset allocation, financial institution service expansion and payment application progress, marks the transition of BTC to mainstream assets; in addition, technological developments such as the maturity of Lightning networks and network security status will also support its value.