TrendX Research Institute: Merlin Chain project analysis and ecological inventory

Mar 24, 2024 am 09:01 AMAccording to statistics on March 2, the total TVL of Bitcoin’s second-layer network MerlinChain has reached US$3 billion. Among them, Bitcoin ecological assets accounted for 90.83%, including BTC worth US$1.596 billion and BRC-20 assets worth US$404 million. Last month, MerlinChain’s total TVL reached US$1.97 billion within 14 days of launching staking activities, surpassing Blast, which was launched in November last year and is also the most recent and equally eye-catching. On February 26, the total value of NFTs in the MerlinChain ecosystem exceeded US$420 million, becoming the public chain project with the highest NFT market value besides Ethereum.

Project Introduction

MerlinChain is a new BTCLayer2 solution supported by OKX. The reason it has attracted so much attention is that it directly solves the core problem of the Bitcoin network - scalability.

Merlin Chain adopts ZK-Rollup to compress a large number of transaction proofs into a simple checksum to improve transaction efficiency and scalability. The sequencer node on top of it is responsible for collecting and batching transactions, generating compressed transaction data, ZK state roots, and attestation via zkEVM. The compressed transaction data and ZK proofs are then uploaded to Taproot on Bitcoin L1 via the decentralized Oracle network. This Taproot is available to the entire network to ensure transparency and security.

Team information:

BitmapTech (formerly RCSV) is the MerlinChain team and has been committed to the development of the Bitcoin ecosystem. They have launched a number of native innovative projects in the past year, and the overall market value of these projects has exceeded US$500 million. Among them, the BRC-420 "blue box" issued by BitmapTech is very popular in the Ordinals protocol, with its price soaring from $0.15 to $34,000, and its market value is second only to BAYC and CryptoPunks. This shows that BitmapTech has made significant achievements in the Bitcoin ecosystem and that their products have received widespread recognition and attention from the market. Through continuous efforts and innovation, BitmapTech has become an important player in the Bitcoin ecosystem and has made important contributions to the development of the entire industry. Their success also reflects the vitality and potential of the Bitcoin ecosystem, demonstrating the huge possibilities for future development.

Financing information: On February 5, Merlin Chain announced the completion of financing, with participation from 24 institutions including OKX Ventures, ABCDE, Foresight Ventures, and Arkstream Capital. The specific financing amount has not yet been disclosed.

Operation activities

1.Launchpad pledge airdrop activity

Total amount of MERL tokens: 2,100,000,000

for sale Price: 0.00004762USDT

On February 5, MerlinChain announced that 1% of the total token supply (i.e. 21 million MERL) will be used for Launchpad through People's Launchpad, with an initial price of 0.00004762 USDT.

On February 8, MerlinChain launched a total of 6 phases of mainnet staking activities and announced that it would release 20% of the tokens for airdrops, which is much higher than the common 5% short position limit for L2 project. This staking activity not only supports BTC native assets (BTC, BRC-420 assets and BTC-20 assets), but also supports EVM assets (which can be deposited into the Ethereum main network or assets on Arbitrum, and you can also obtain exclusive native staking income). Rewards can be earned by providing liquidity to MerlinChain’s native DexMerlinSwap.

On February 16, MerlinChain continued to launch the second phase of Merlin'sSeal, adding blue wand, dragon ball and mainstream assets on ZKFair as pledged assets.

On February 19, MerlinChain launched the first BRC-20 token $VOYA airdrop, and further added pledged assets NodeMonkes, BitcoinPuppets, BitcoinFrogs, etc.

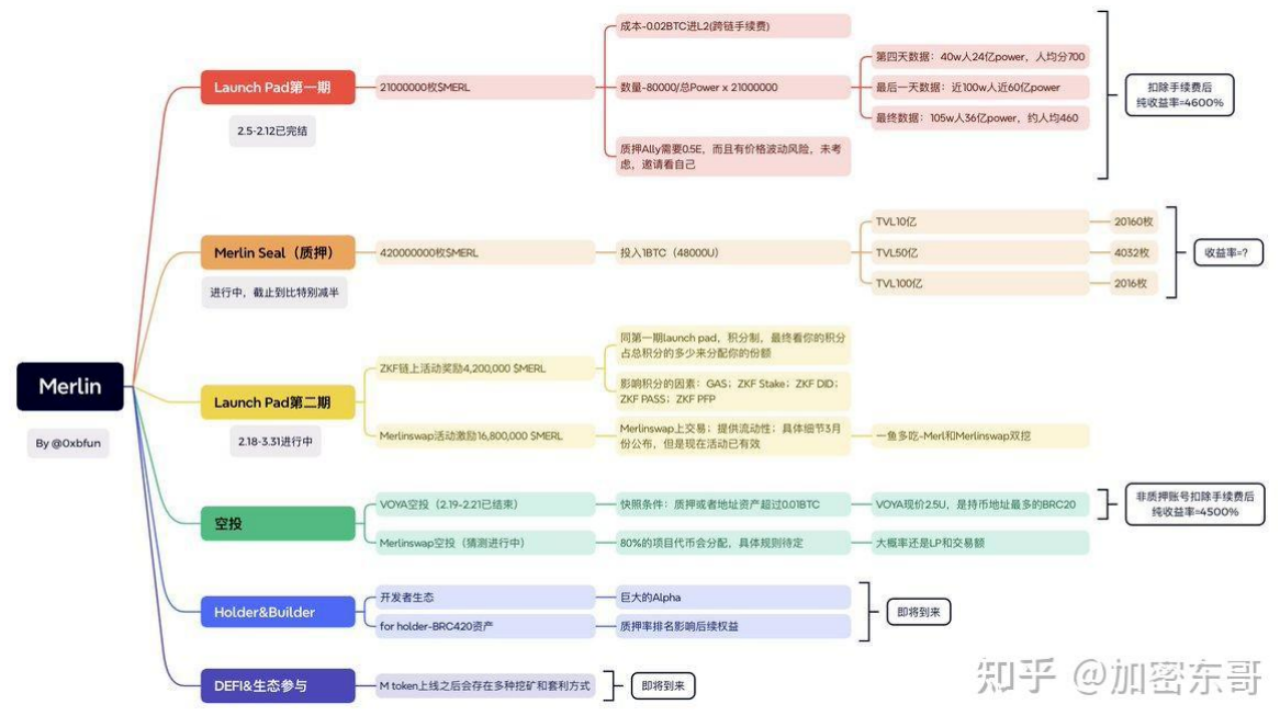

Picture source: Zhihu Column Encryption Dongge

2. Interactive cooperation

On February 13, the full-chain liquidity distribution network StakeStone established a strategic partnership with MerlinChain. Provide staking and upcoming Restaking re-staking rewards for users’ ETH staked in the MerlinSeal event.

On February 16, the Bitcoin Layer2 network MAPProtocol and MerlinChain reached a cooperation, which will bring Bitcoin-level security between Bitcoin L2 and between different Bitcoin L2 and EVM ecological chains. Point-to-point cross-chain interoperability.

On February 21, BTC’s native stablecoin protocol bitSmiley reached an official strategic cooperation with the BTCLayer2 network MerlinChain. bitSmiley's native asset bitDisc-BlackNFT joins the MerlinSeal event and becomes one of the BTC assets recognized by the Merlin mainnet event.

On February 26, the crypto exchange BIT announced that it has reached a cooperation with MerlinChain and will serve as the official custodian to support users to pledge ETHS assets on MerlinChain, becoming users to pledge ETHS and accumulate airdrop M points. exclusive channel.

On February 27, OKXWeb3 wallet officially announced that it has been connected to the MerlinChain network. Users do not need to manually configure it. They can switch to the MerlinChain network with one click for corresponding currency management. In addition, MerlinChain network ecological DApp interaction can be simultaneously realized in the OKXWeb3 wallet discovery section.

On February 27, TRON announced a strategic cooperation with MerlinChain. Both parties will work together to expand the interoperability, practicality and financial accessibility of Bitcoin.

3.KOL operation and maintenance

The MerlinChain team should also be very proactive and enthusiastic about the operation and maintenance of KOL. Merlin Chain started so quickly. On the one hand, it is inseparable from the positive development of the Bitcoin chain environment. On the other hand, it is also inseparable from the project team’s operation methods that can be called textbook templates. The focus of the project team has always been the community, and the 20% airdrop ratio and KOL promotion are the most efficient ways to ignite the enthusiasm of the masses.

Online Ecological Inventory

It has attracted a large number of players and attention through excellent operational activities, and the team is also constantly improving the construction of MerlinChain. There are currently 6 projects that have been deployed on the network:

Cross-chain bridge:

Official cross-chain bridge MerlinBridge: It is the official cross-chain bridge project of Merlin Chain and can now support a variety of types assets are pledged to MerlinSeal.

Three-party cooperation stablecoin cross-chain bridge Meson: Meson is a stablecoin trading protocol that promotes the free flow of stablecoins between Ethereum, Layer2 and major high-performance public chains. With its new product design and technology stack, Meson offers peer-to-peer trading between major stablecoins on any supported network, with the significant advantages of fast confirmations, low fees and zero slippage.

The above is the detailed content of TrendX Research Institute: Merlin Chain project analysis and ecological inventory. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to avoid risks in the turmoil in the currency circle? The TOP3 stablecoin list is revealed

Jul 08, 2025 pm 07:27 PM

How to avoid risks in the turmoil in the currency circle? The TOP3 stablecoin list is revealed

Jul 08, 2025 pm 07:27 PM

Against the backdrop of violent fluctuations in the cryptocurrency market, investors' demand for asset preservation is becoming increasingly prominent. This article aims to answer how to effectively hedge risks in the turbulent currency circle. It will introduce in detail the concept of stablecoin, a core hedge tool, and provide a list of TOP3 stablecoins by analyzing the current highly recognized options in the market. The article will explain how to select and use these stablecoins according to their own needs, so as to better manage risks in an uncertain market environment.

Stable coin arbitrage annualized by 20% and earn passive income using the BUSD and TUSD spreads

Jul 08, 2025 pm 07:15 PM

Stable coin arbitrage annualized by 20% and earn passive income using the BUSD and TUSD spreads

Jul 08, 2025 pm 07:15 PM

This article will focus on the theme of stablecoin arbitrage and explain in detail how to use the possible price spreads between stablecoins such as BUSD and TUSD to obtain profits. The article will first introduce the basic principles of stablecoin spread arbitrage, and then introduce the specific operating procedures through step-by-step explanations, and analyze the risks involved and matters that need to be paid attention to to help users understand this process and realize that its returns are not stable and unchanged.

Must-read for beginners: The real use of Bitcoin, 99% of BTC application scenarios that novices don't know

Jul 08, 2025 pm 06:12 PM

Must-read for beginners: The real use of Bitcoin, 99% of BTC application scenarios that novices don't know

Jul 08, 2025 pm 06:12 PM

Many friends who are first exposed to Bitcoin may simply understand it as a high-risk investment product. This article will explore the real uses of Bitcoin beyond speculation and reveal those often overlooked application scenarios. We will start from its core design philosophy and gradually analyze how it works in different fields as a value system, helping you build a more comprehensive understanding of Bitcoin.

Global stablecoin market value PK! Who is the gold substitute in the bear market

Jul 08, 2025 pm 07:24 PM

Global stablecoin market value PK! Who is the gold substitute in the bear market

Jul 08, 2025 pm 07:24 PM

This article will discuss the world's mainstream stablecoins and analyze which stablecoins have the risk aversion attribute of "gold substitute" in the market downward cycle (bear market). We will explain how to judge and choose a relatively stable value storage tool in a bear market by comparing the market value, endorsement mechanism, transparency, and comprehensively combining common views on the Internet, and explain this analysis process.

How to obtain the US MSB license in 45 days? Detailed explanation of the three essential certificates for virtual currency compliance operations

Jul 08, 2025 pm 07:42 PM

How to obtain the US MSB license in 45 days? Detailed explanation of the three essential certificates for virtual currency compliance operations

Jul 08, 2025 pm 07:42 PM

This article will explain in detail how to successfully apply for a US MSB (Money Services Business) license within a theoretical 45-day cycle and disassemble the key steps in the application process to help you understand the entire operation process. At the same time, the article will also introduce two other important compliance licenses in the virtual currency industry, providing reference for you to build a global compliance operation system.

Virtual Currency Stable Coins Ranking Which is the 'safe haven' in the currency circle

Jul 08, 2025 pm 07:30 PM

Virtual Currency Stable Coins Ranking Which is the 'safe haven' in the currency circle

Jul 08, 2025 pm 07:30 PM

This article will introduce several mainstream stablecoins and explain in depth how to evaluate the security of a stablecoin from multiple dimensions such as transparency and compliance, so as to help you understand which stablecoins are generally considered relatively reliable choices in the market, and learn how to judge their "hazard-haven" attributes on your own.

Yiwu merchants start charging stablecoins

Jul 08, 2025 pm 11:57 PM

Yiwu merchants start charging stablecoins

Jul 08, 2025 pm 11:57 PM

Under the trend of Yiwu merchants accepting stablecoin payment, it is crucial to choose a reliable exchange. This article sorts out the world's top virtual currency exchanges. 1. Binance has the largest trading volume and strong liquidity, supports multiple fiat currency deposits and exits and has a security fund; 2. OKX has a rich product line, built-in Web3 wallet, and has high asset transparency; 3. Huobi (Huobi/HTX) has a long history and a huge user base, and is actively improving security and experience; 4. Gate.io has a variety of currencies, focusing on security and audit transparency; 5. KuCoin has a friendly interface, suitable for beginners and supports automated trading; 6. Bitget is known for its derivatives and order functions, suitable for users who explore diversified strategies.

80% of license application loopholes that the platform does not know about. Compliance experts teach you how to use the 'curve approved' strategy

Jul 08, 2025 pm 07:33 PM

80% of license application loopholes that the platform does not know about. Compliance experts teach you how to use the 'curve approved' strategy

Jul 08, 2025 pm 07:33 PM

Under the current severe regulatory environment, the difficulty of directly applying for a specific business license is increasing day by day, and the success rate is not ideal. Many platforms have therefore fallen into development bottlenecks. This article will analyze in detail an efficient "curve approval" strategy, aiming to help you understand how to obtain the required license through indirect compliance. This article will explain its operational process and core points in steps, providing you with a feasible compliance path.