As an individual frequently working with financial data in Excel, I often rely on the YIELD function to evaluate bond investments. Understanding yield is crucial for those involved in fixed-income securities, as it aids in determining the annual return an investor might anticipate. In this article, I will guide you through the YIELD function in Excel, its syntax, and effective usage.

Key Takeaways:

- The YIELD function in Excel assists in calculating the annual return on a bond investment.

- It takes into account elements such as purchase price, coupon payments, and maturity value.

- Ensuring proper date formatting and accurate bond detail input is essential for precise results.

- Investors leverage this function to compare different bonds based on their anticipated returns.

- Advanced functions like YIELDMAT and ODDLYIELD cater to special bond structures.

Table of Contents

Introduction to Excel Yield Mastery

The Significance of the Yield Formula in Finance

In the realm of finance, understanding investment yield is vital. When I analyze bonds or other debt instruments, I depend on the yield formula to estimate the return. This formula helps me gauge the profitability of a bond by considering the purchase price, coupon payments, and maturity value. It's an effective method to evaluate the worthiness of an investment and compare different bonds efficiently.

Uncovering the YIELD Function

What is the YIELD Function?

Breaking Down the Formula Syntax

The YIELD function in Excel is a financial tool that computes the yield on a security that pays periodic interest, specifically designed for bonds. It is widely utilized in the finance sector to ascertain the returns expected from a bond investment, considering its annual coupon payments, price, and other related factors. The YIELD function in Excel follows this syntax:

=YIELD(settlement, maturity, rate, pr, redemption, frequency, [basis]) ### Breaking Down the Arguments

- settlement – The bond’s settlement date (the date the buyer purchases the bond).

- maturity – The bond’s maturity date (when it expires and the principal is repaid).

- rate – The bond’s annual coupon interest rate (expressed as a decimal).

- pr – The bond’s current price per $100 face value.

- redemption – The bond’s redemption (or face) value per $100.

-

frequency – The number of interest payments per year:

-

1= Annual -

2= Semi-annual -

4= Quarterly

-

-

[basis] (optional) – The day count basis used for calculations:

-

0(default) = US (30/360) -

1= Actual/Actual -

2= Actual/360 -

3= Actual/365 -

4= European (30/360)

-

This function is particularly beneficial for bond investors, as it calculates the yield based on current market conditions.

Mastering the Steps to Calculate Bond Yield

Key Assumptions Before Using the YIELD Function

Before employing the YIELD function in Excel, I ensure a few key details are set up correctly to achieve precise calculations:

- Correct Date Formatting – The bond’s settlement and maturity dates must be entered accurately in Excel to prevent errors.

- Accurate Price & Redemption Value – The bond’s current market price and its face (redemption) value should be inputted correctly.

- Payment Frequency – It's crucial to determine whether interest payments are annual, semi-annual, or quarterly, as this affects the yield calculation.

- Defined Coupon Rate – The coupon rate (the interest rate the bond pays) must be explicitly specified.

By ensuring these factors are correctly set up, I can confidently use the YIELD function to analyze bond returns with accuracy.

Step-by-Step Guide: How to Use the YIELD Function in Excel

Let’s walk through an example of calculating bond yield using the YIELD function in Excel. Suppose I have a bond with the following details:

- Settlement Date: January 1, 2024

- Maturity Date: January 1, 2029

- Annual Coupon Rate: 5%

- Current Price: $950

- Redemption Value (Face Value): $1,000

- Payment Frequency: Semi-Annual (2 times per year)

Here’s how I can calculate the bond’s yield:

STEP 1: Enter the bond details into separate cells in Excel:

STEP 2: Select the cell where I want to display the bond’s yield (e.g., G2).

STEP 3: Type the formula in that cell G2:

=YIELD(A2, B2, C2, D2, E2, F2, 0)

STEP 4: Press Enter to calculate the yield. Excel will compute and display the yield as a percentage.

This approach ensures that I obtain an accurate yield calculation with minimal effort, aiding in efficient bond return analysis.

Practical Applications and Examples

Real-World Scenarios: Corporate vs. Treasury Bonds

In real-world situations, investors might compare yields between corporate and treasury bonds to inform investment decisions. Corporate bonds generally offer higher yields to offset their increased risk compared to treasury bonds, which are government-backed and considered safer investments.

By using the YIELD function in Excel, one can evaluate the expected income from both types of bonds over time, taking into account their unique features, such as coupon rates, prices, and maturity dates.

Avoiding Common Pitfalls

Missteps to Watch Out For When Calculating Yield

When calculating yield, precision is essential. However, errors can occur in the following areas:

- Incorrect date formats: Settlement and maturity dates must be in the correct Excel date format, or the function will return an error.

- Overlooking frequency: Failing to correctly input the frequency of payments (annual, semiannual, etc.) leads to inaccurate yield calculations.

- Mismatched terms: Ensure the rate and terms of the bond are aligned; for example, an annual rate with annual payments, not semiannual.

- Price and redemption values: Misinterpreting the bond’s price and its face value or redemption value can distort the result.

Beyond the Basics: Advanced YIELD Function Usage

Exploring Related Functions Like YIELDMAT and ODDLYIELD

When analyzing bond investments in Excel, I find it beneficial to explore other financial functions related to yield for a more thorough evaluation. Functions like YIELDMAT and ODDLYIELD enable me to handle various bond structures effectively.

- YIELDMAT calculates the annual yield of a bond that pays interest only at maturity—this is useful for zero-coupon bonds or securities that don’t make periodic payments.

- ODDLYIELD is designed for bonds with an irregular last period, which can occur when the final coupon payment doesn’t align with the standard schedule.

By utilizing these functions, I can evaluate bonds with different payment structures beyond traditional ones.

Maximizing Investment Decisions with Yield Calculations

Yield calculations are not merely an academic exercise; they are crucial for making informed investment decisions. By meticulously analyzing the yield on various securities, investors can select investments that align with their risk tolerance and return expectations. Additionally, yield calculations assist in building a diversified portfolio by comparing potential returns across different asset classes and market sectors, thus facilitating more strategic investment choices.

FAQ – Frequently Asked Questions

What is the formula for %yield?

The formula for calculating percentage yield, often known as yield to maturity (YTM) for bonds, in Excel is:

=YIELD(settlement, maturity, rate, pr, redemption, frequency, [basis])

Here, settlement is the settlement date, maturity is the maturity date, rate is the annual coupon rate, pr is the price of the bond, redemption is the bond’s redemption value, and frequency is the number of coupon payments per year. The basis is an optional argument for the day count basis.

How to use yield function in excel?

To use the yield function in Excel, input the necessary bond information such as settlement date, maturity date, annual coupon rate, bond’s price, and redemption value. Then, follow these steps:

- Click on the cell where you want to display the yield.

- Type

=YIELD(to initiate the formula. - Add references to the cells containing the bond information, separated by commas.

- Close the parenthesis and press

Enter.

The yield will be calculated and shown in the chosen cell.

Can I Calculate a Bond’s Yield to Maturity By Hand?

Yes, it is possible to calculate a bond’s yield to maturity manually, but it is a complex process, particularly for bonds with longer maturities, as it involves the present value of coupon payments. Therefore, using software like Excel or a financial calculator is recommended to simplify the task and provide more accurate results.

How Is YTM Used by Investors to Make Decisions?

Yield to Maturity (YTM) is a vital tool for investors as it offers a comprehensive measure of a bond’s profitability if held until maturity. It accounts for all coupon payments and the principal amount at maturity. Investors use YTM to compare the potential returns of different bonds, assess the risks, and decide whether the bond aligns with their investment strategy and yield expectations.

What happens if I input incorrect dates in the YIELD function?

Incorrectly formatted settlement and maturity dates can cause the YIELD function to return an error. Excel requires dates to be entered in a recognizable format, and they must be valid calendar dates. If there’s an issue, double-check the date format or use Excel’s DATE function for accuracy.

The above is the detailed content of The Ultimate Guide to Yield Formula in Excel. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to Use Parentheses, Square Brackets, and Curly Braces in Microsoft Excel

Jun 19, 2025 am 03:03 AM

How to Use Parentheses, Square Brackets, and Curly Braces in Microsoft Excel

Jun 19, 2025 am 03:03 AM

Quick Links Parentheses: Controlling the Order of Opera

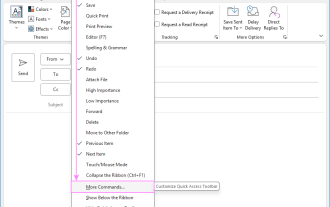

Outlook Quick Access Toolbar: customize, move, hide and show

Jun 18, 2025 am 11:01 AM

Outlook Quick Access Toolbar: customize, move, hide and show

Jun 18, 2025 am 11:01 AM

This guide will walk you through how to customize, move, hide, and show the Quick Access Toolbar, helping you shape your Outlook workspace to fit your daily routine and preferences. The Quick Access Toolbar in Microsoft Outlook is a usefu

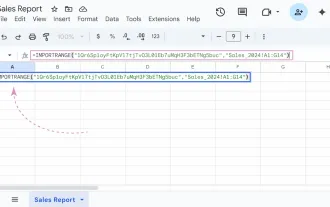

Google Sheets IMPORTRANGE: The Complete Guide

Jun 18, 2025 am 09:54 AM

Google Sheets IMPORTRANGE: The Complete Guide

Jun 18, 2025 am 09:54 AM

Ever played the "just one quick copy-paste" game with Google Sheets... and lost an hour of your life? What starts as a simple data transfer quickly snowballs into a nightmare when working with dynamic information. Those "quick fixes&qu

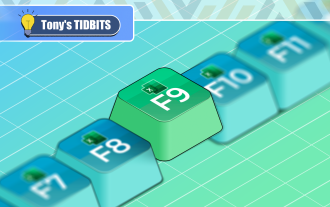

Don't Ignore the Power of F9 in Microsoft Excel

Jun 21, 2025 am 06:23 AM

Don't Ignore the Power of F9 in Microsoft Excel

Jun 21, 2025 am 06:23 AM

Quick LinksRecalculating Formulas in Manual Calculation ModeDebugging Complex FormulasMinimizing the Excel WindowMicrosoft Excel has so many keyboard shortcuts that it can sometimes be difficult to remember the most useful. One of the most overlooked

6 Cool Right-Click Tricks in Microsoft Excel

Jun 24, 2025 am 12:55 AM

6 Cool Right-Click Tricks in Microsoft Excel

Jun 24, 2025 am 12:55 AM

Quick Links Copy, Move, and Link Cell Elements

Prove Your Real-World Microsoft Excel Skills With the How-To Geek Test (Advanced)

Jun 17, 2025 pm 02:44 PM

Prove Your Real-World Microsoft Excel Skills With the How-To Geek Test (Advanced)

Jun 17, 2025 pm 02:44 PM

Whether you've recently taken a Microsoft Excel course or you want to verify that your knowledge of the program is current, try out the How-To Geek Advanced Excel Test and find out how well you do!This is the third in a three-part series. The first i

How to recover unsaved Word document

Jun 27, 2025 am 11:36 AM

How to recover unsaved Word document

Jun 27, 2025 am 11:36 AM

1. Check the automatic recovery folder, open "Recover Unsaved Documents" in Word or enter the C:\Users\Users\Username\AppData\Roaming\Microsoft\Word path to find the .asd ending file; 2. Find temporary files or use OneDrive historical version, enter ~$ file name.docx in the original directory to see if it exists or log in to OneDrive to view the version history; 3. Use Windows' "Previous Versions" function or third-party tools such as Recuva and EaseUS to scan and restore and completely delete files. The above methods can improve the recovery success rate, but you need to operate as soon as possible and avoid writing new data. Automatic saving, regular saving or cloud use should be enabled

5 New Microsoft Excel Features to Try in July 2025

Jul 02, 2025 am 03:02 AM

5 New Microsoft Excel Features to Try in July 2025

Jul 02, 2025 am 03:02 AM

Quick Links Let Copilot Determine Which Table to Manipu