How to Find APR in Excel – Step by Step APR Calculation

May 16, 2025 pm 05:38 PMWhen dealing with financial data in Excel, calculating the Annual Percentage Rate (APR) is a fundamental task that enhances the efficiency of financial analysis, whether for loans, credit card interest, or mortgage rates. This article will guide you through the process of calculating APR in Excel, highlight its differences from other interest rates, and provide step-by-step instructions.

Key Takeaways:

- Excel streamlines APR calculations, boosting the efficiency of financial analysis.

- The RATE function calculates APR based on loan payments and terms.

- The EFFECT function transforms nominal rates into effective APRs for better comparisons.

- Including fees in the calculations ensures a more precise cost of borrowing.

- Organizing data correctly in Excel guarantees accuracy and reduces errors.

Table of Contents

Introduction

Understanding APR and Its Importance

The Annual Percentage Rate (APR) is a vital financial metric that represents the annual cost of borrowing, including both interest and additional fees. It offers a comprehensive view of the annual cost of a loan or credit, facilitating effective comparisons between different financial products. Whether for mortgages, consumer loans, or credit cards, APR acts as a benchmark for making informed financial choices.

APR isn't merely the interest rate; it adds transparency by incorporating fees like underwriting or origination fees. Thus, APR often gives a more complete picture of the borrowing cost than the interest rate alone. Gaining a thorough understanding of APR is crucial for financial literacy when dealing with loans and credit products.

Why Use Excel for APR Calculations?

Excel is an excellent tool for managing data and performing complex calculations, making it ideal for APR calculations. Why choose Excel? Firstly, it can manage intricate formulas and large datasets effortlessly. It's particularly useful for adjusting and comparing numbers when evaluating different loans or financial products.

Secondly, Excel saves time. Manually calculating APR for multiple loans or credit cards is time-consuming, but with Excel, once the formula is set up, it can be reused multiple times. Moreover, Excel reduces the chance of human calculation errors, ensuring accuracy when the setup is correct.

Using Excel also allows integration with AI tools, which can suggest formulas, automate calculations, and provide insights into key data points for your APR calculations. This blend of Excel's traditional functions and AI-driven insights streamlines the calculation process, saving both time and effort.

Preparing Your Excel Sheet for APR Calculations

Organizing Your Data Inputs

Before you calculate APR in Excel, it's essential to set up your spreadsheet by organizing all necessary data inputs. Properly organizing your data will make the calculation process smoother and more accurate. Here's how to do it:

- Loan Amount: Start by entering the total borrowed amount in one column. This should be the principal amount of the loan without adjustments for interest or fees.

- Interest Rate: Enter the nominal annual interest rate provided by the lender. Express this rate as a decimal for use in Excel calculations.

- Loan Term: Specify the repayment period of the loan in years, as APR calculations typically require annualized figures.

Organizing these inputs into distinct, clearly labeled columns sets the foundation for an accurate and efficient APR calculation. Comprehensive and organized data allows you to effectively use Excel's functions, maintain consistency across calculations, and minimize errors. Proper data preparation is the first step in simplifying the often complex task of financial analysis.

Common Techniques for Calculating APR in Excel

Using the RATE Function with Examples

The RATE function in Excel is a versatile tool for calculating the periodic interest rate needed to pay off a loan or reach a future investment value, based on given payment amounts and periods. Here’s how to use this function, with concrete examples.

The basic syntax for the RATE function is:

=RATE(nper, pmt, pv, [fv], [type], [guess])

- nper: Total number of payment periods.

- pmt: Payment made each period; it remains constant over the loan or investment life.

- pv: Present value or the total amount the future payments are worth now.

- fv (optional): Future value or desired cash balance after the last payment.

- type (optional): Payment timing; 0 for end of period, 1 for beginning.

- guess (optional): Initial guess for the rate.

For example, if you have a 5-year loan of $10,000 with monthly payments of $200, you would enter:

=RATE(60, -200, 10000) * 12

This calculation gives you the APR.

The EFFECT Function Explained

The EFFECT function in Excel is essential for calculating the effective annual interest rate, especially for loans with more frequent compounding periods than annually. It provides a more accurate representation of the true borrowing cost, enabling better comparisons between financial products.

The syntax for the EFFECT function is:

=EFFECT(nominal_rate, npery)

- nominal_rate: The nominal interest rate, expressed as a decimal. Convert the nominal rate from a percentage to a decimal by dividing by 100.

- npery: The number of compounding periods per year. For example, use 12 for monthly compounding or 4 for quarterly compounding.

If you have a nominal APR of 7.5% with monthly compounding, you would use:

=EFFECT(7.5%, 12)

This gives you the effective APR, offering a clearer understanding of your annual borrowing costs by accounting for compound interest. The EFFECT function is invaluable for understanding the true annual rate of loans or investments with frequent compounding, ensuring a fair comparison by converting nominal rates to effective ones, thus revealing the actual annual cost.

This knowledge is crucial when comparing different financial products or assessing the impact of compounding on borrowed funds.

Using the NOMINAL Function

Sometimes, converting the APR to a nominal rate is necessary. The NOMINAL function assists with this:

=NOMINAL(effect_rate, npery)

Where effect_rate is the effective interest rate, and npery is the number of compounding periods per year.

Advanced Tips for Accurate Calculations

Factoring in Fees and Charges

When calculating APR, it's crucial to include fees and charges to accurately reflect the total cost of the loan. These fees, often overlooked, can significantly affect the effective interest rate. Here’s how to incorporate them:

STEP 1: Start by listing all upfront costs related to the loan, such as origination fees, application processing fees, and underwriting fees. These should be detailed in the loan agreement.

STEP 2: In Excel, subtract the total fees from the principal amount to get the effective loan amount you receive. This adjusted principal is essential for an accurate APR calculation.

Use the adjusted loan amount as the present value (pv) in the RATE function. This ensures the calculation reflects the actual funds available to you, not just the nominal loan amount.

Excel Sample Formula:

=RATE(nper, pmt, original_principal – total_fees) * 12

If the loan includes future costs like periodic maintenance fees, they should be included in the cash flows, ensuring the total cost is reflected in your APR calculation.

By carefully including all fees and charges in your APR calculations, you gain a more comprehensive understanding of the true cost of borrowing. This approach aids in effectively comparing different loan offers, equipping you with the information needed to make informed financial decisions.

FAQs

1. What distinguishes APR from the interest rate?

APR encompasses both the interest rate and additional fees, providing a more accurate depiction of the loan’s total cost. The interest rate only reflects the cost of borrowing without fees. Comparing APRs rather than just interest rates offers a better understanding of overall expenses.

2. How does the RATE function compute APR in Excel?

The RATE function calculates the periodic interest rate needed to repay a loan, which is then annualized to determine the APR. It takes into account factors like the number of payment periods, loan amount, and monthly payment. Multiplying the result by 12 converts the monthly rate into an annual percentage.

3. Why is the EFFECT function used for APR calculations?

The EFFECT function is useful when dealing with compounding interest, as it converts nominal rates to effective annual rates. This ensures fair comparisons between financial products with different compounding periods. It is especially helpful for evaluating credit cards, mortgages, and other loans with frequent compounding.

4. How do fees impact APR calculations?

Fees increase the overall cost of borrowing, resulting in a higher effective interest rate than the stated interest rate. Subtracting fees from the loan principal before using the RATE function provides a more accurate APR. This approach ensures that all hidden costs are considered in financial decisions.

5. What are common errors when calculating APR in Excel?

Errors can arise from using incorrect payment periods, ignoring fees, or misusing functions like RATE or EFFECT. Ensuring all inputs are in the correct format—such as decimal interest rates and consistent time units—helps maintain accuracy. Properly organizing data in Excel also minimizes calculation mistakes.

The above is the detailed content of How to Find APR in Excel – Step by Step APR Calculation. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to Use Parentheses, Square Brackets, and Curly Braces in Microsoft Excel

Jun 19, 2025 am 03:03 AM

How to Use Parentheses, Square Brackets, and Curly Braces in Microsoft Excel

Jun 19, 2025 am 03:03 AM

Quick Links Parentheses: Controlling the Order of Opera

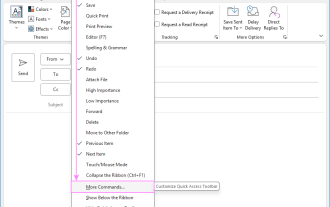

Outlook Quick Access Toolbar: customize, move, hide and show

Jun 18, 2025 am 11:01 AM

Outlook Quick Access Toolbar: customize, move, hide and show

Jun 18, 2025 am 11:01 AM

This guide will walk you through how to customize, move, hide, and show the Quick Access Toolbar, helping you shape your Outlook workspace to fit your daily routine and preferences. The Quick Access Toolbar in Microsoft Outlook is a usefu

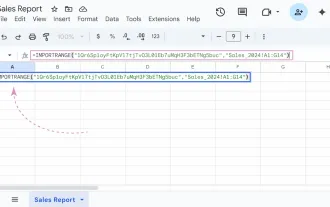

Google Sheets IMPORTRANGE: The Complete Guide

Jun 18, 2025 am 09:54 AM

Google Sheets IMPORTRANGE: The Complete Guide

Jun 18, 2025 am 09:54 AM

Ever played the "just one quick copy-paste" game with Google Sheets... and lost an hour of your life? What starts as a simple data transfer quickly snowballs into a nightmare when working with dynamic information. Those "quick fixes&qu

6 Cool Right-Click Tricks in Microsoft Excel

Jun 24, 2025 am 12:55 AM

6 Cool Right-Click Tricks in Microsoft Excel

Jun 24, 2025 am 12:55 AM

Quick Links Copy, Move, and Link Cell Elements

Don't Ignore the Power of F9 in Microsoft Excel

Jun 21, 2025 am 06:23 AM

Don't Ignore the Power of F9 in Microsoft Excel

Jun 21, 2025 am 06:23 AM

Quick LinksRecalculating Formulas in Manual Calculation ModeDebugging Complex FormulasMinimizing the Excel WindowMicrosoft Excel has so many keyboard shortcuts that it can sometimes be difficult to remember the most useful. One of the most overlooked

Prove Your Real-World Microsoft Excel Skills With the How-To Geek Test (Advanced)

Jun 17, 2025 pm 02:44 PM

Prove Your Real-World Microsoft Excel Skills With the How-To Geek Test (Advanced)

Jun 17, 2025 pm 02:44 PM

Whether you've recently taken a Microsoft Excel course or you want to verify that your knowledge of the program is current, try out the How-To Geek Advanced Excel Test and find out how well you do!This is the third in a three-part series. The first i

How to recover unsaved Word document

Jun 27, 2025 am 11:36 AM

How to recover unsaved Word document

Jun 27, 2025 am 11:36 AM

1. Check the automatic recovery folder, open "Recover Unsaved Documents" in Word or enter the C:\Users\Users\Username\AppData\Roaming\Microsoft\Word path to find the .asd ending file; 2. Find temporary files or use OneDrive historical version, enter ~$ file name.docx in the original directory to see if it exists or log in to OneDrive to view the version history; 3. Use Windows' "Previous Versions" function or third-party tools such as Recuva and EaseUS to scan and restore and completely delete files. The above methods can improve the recovery success rate, but you need to operate as soon as possible and avoid writing new data. Automatic saving, regular saving or cloud use should be enabled

5 New Microsoft Excel Features to Try in July 2025

Jul 02, 2025 am 03:02 AM

5 New Microsoft Excel Features to Try in July 2025

Jul 02, 2025 am 03:02 AM

Quick Links Let Copilot Determine Which Table to Manipu