Pro rata, a term derived from Latin meaning "in proportion," is essential in numerous financial scenarios to guarantee an equitable allocation, such as in salary disbursements or the distribution of dividends. By mastering pro rata calculations in Microsoft Excel, one can ensure fairness and accuracy in financial transactions, making it a vital concept in finance for promoting transparency and equity. Excel, with its sophisticated functions and formulas, offers an ideal platform for executing pro rata calculations efficiently and precisely.

Key Takeaways

- Excel's YEARFRAC function is instrumental in calculating the fraction of the year between two dates, which is perfect for determining pro rata shares over periods shorter than a year.

- For pro rata calculations based on the number of days, the DAYS function can directly compute the days between two dates, streamlining processes like calculating a tenant's rent based on their duration of stay.

- Excel's capability to automate calculations using formulas reduces the chance of human error and enhances the efficiency of determining pro rata shares, leading to more accurate and streamlined financial transactions.

- From dividing utility costs in shared accommodations to allocating bonuses among part-time workers, applying pro rata calculations in Excel through real-world examples improves understanding and implementation of the concept across various financial scenarios.

Download the spreadsheet and follow along with the tutorial on How to Calculate Pro Rata Share in Excel – download excel workbookCalculate-Pro-Rata-Share-Effortlessly-with-Easy-Excel-Tips.xlsx

Table of Contents

Introduction To Pro Rata Share Calculations

Demystifying the Concept of Pro Rata

Pro rata, originating from Latin and translating to "in proportion," is pivotal in a wide array of financial contexts. This concept ensures that each individual receives their fair share, whether it's a partial salary payment or the precise division of dividends among shareholders. Understanding pro rata is a step towards achieving fairness and precision in financial dealings.

Importance of Understanding Pro Rata in Financial Decisions

Grasping the concept of pro rata is crucial for making informed financial decisions that involve equitable distribution. When you understand pro rata, you are better equipped to ensure that whether it's dividing an insurance premium, calculating a part-time employee's salary, or distributing project expenses, each party's share is fair and accurate.

It's a fundamental principle in finance that supports transparent and justifiable financial practices, essential for fostering trust among stakeholders.

Excel and Pro Rata: A Perfect Pair

Advantages of Using Excel for Pro Rata Calculations

Utilizing Excel for pro rata calculations provides significant benefits. Its array of features enables quick and accurate computations, minimizing the risk of errors that often occur with manual calculations. Excel's grid layout is ideally suited for organizing and breaking down data, making it easier to see shares and contributions clearly. Moreover, Excel's built-in functions and formulas can automate the process, transforming what was once a tedious task into a few simple clicks.

Step-by-Step Guide to Effortless Pro Rata Calculation

Using the YEARFRAC Function

The YEARFRAC function calculates the fraction of the year represented by the number of whole days between two dates. This function is particularly useful for financial calculations where the exact duration of the period in terms of the year is crucial.

=YEARFRAC(start_date, end_date, [basis])

- start_date and end_date are the two dates between which you want to calculate the year fraction.

- [basis] is an optional argument that specifies the day count convention to use. It can range from 0 to 4, representing different conventions like actual/actual, actual/360, etc. If omitted, Excel uses 0 (US (NASD) 30/360) by default.

To calculate the pro rata share of an annual investment of $10,000 for the period from March 1, 2023, to August 31, 2023:

STEP 1: Enter the start date in cell A1 (3/1/2023) and the end date in cell B1 (8/31/2023).

STEP 2: Enter the total annual amount in cell C1 ($10,000).

STEP 3: In cell D1, use the formula to calculate the pro rata share:

=C1*YEARFRAC(A1, B1)

This formula will provide the proportion of the annual amount that corresponds to the period between the two dates.

Using the DAYS Function

The DAYS function calculates the number of days between two dates, which is useful for more straightforward pro rata calculations where the basis is simply the number of days.

=DAYS(end_date, start_date)

- end_date is the end date of the period.

- start_date is the start date of the period.

To calculate the pro rata share of the annual expense of $3,000 for a tenant based on the number of days they stayed, follow the steps below:

STEP 1: For each tenant, enter their name and the start and end dates of their tenancy in columns A, B, and C, respectively.

STEP 2: In column D, use the DAYS function to calculate the total days each tenant occupied the property. Add 1 to the formula.

=DAYS(C2, B2) 1

STEP 3: Drag this formula down the column to apply it to all tenants.

STEP 4: In column E, enter the following formula to find the amount to be paid as rent.

=D2/SUM($D$2:$D$5)*3000

Calculating pro rata shares for tenants with different occupancy dates in Excel requires a detailed setup but follows a straightforward process. This calculation provides the tenant's pro rata share of the annual expense based on the number of days they occupied the property.

Real-Life Examples: Pro Rata Calculation Applied

Sharing Utility Costs in Shared Housing

In shared housing, the fair distribution of utility costs is often a concern, and this is where pro rata calculations prove invaluable. By determining each resident's share based on factors such as room size or individual usage, pro rata promotes a sense of fairness.

Excel can handle these calculations by allocating costs in proportion to the agreed-upon factors, ensuring each housemate pays their fair share of the bills, fostering a harmonious living environment.

Allocating Year-End Bonuses Among Part-time Employees

When it's time to distribute year-end bonuses, part-time employees should not be overlooked. Pro rata calculations can be used to fairly allocate these bonuses to part-time staff based on the number of hours they've worked throughout the year. This ensures that bonuses accurately reflect employees' contributions and are distributed equitably.

Use Excel to efficiently perform this task by applying formulas that proportionally divide the total bonus pool by the hours worked, ensuring a fair distribution that is transparent and morale-boosting for all team members.

Frequently Asked Questions (FAQ)

How do you calculate pro rata in Excel?

To calculate pro rata in Excel, enter your values and use the formula (Amount / Total Units) * Units Used in a cell. Replace "Amount" with the total sum to be allocated, "Total Units" with the full value that amount represents, and "Units Used" with the portion you're calculating for. Press Enter, and Excel will display the pro rata amount.

What is the simplest formula for calculating pro rata shares?

The simplest formula for calculating pro rata shares is Pro Rata Share = (Individual Share / Total of All Shares) x Total Distribution. This quickly provides each party's proportional share of the total amount being divided.

Can Excel calculate pro rata based on varying periods or dates?

Yes, Excel can calculate pro rata based on varying periods or dates. Use the formula Pro Rata Amount = (Total Amount * Number of Days in Period) / Total Days in Year and adjust the date ranges to suit the specific period you're dealing with. Use Excel's date functions to assist with calculations involving days.

How do I avoid common pitfalls in pro rata calculations within Excel?

To avoid common pitfalls in pro rata calculations within Excel, ensure accurate data input, use correct formulas, apply conditional formatting to spot inconsistencies, and double-check calculations with Excel's auditing tools. Always cross-reference outcomes against manual calculations for additional verification.

How does pro rata apply to dividends per share?

Pro rata applies to dividends per share by ensuring each shareholder receives a portion of dividends directly proportional to their number of shares. The formula Dividend Per Share = Total Dividends / Total Shares Owned calculates the exact amount due per share, reflecting the equitable distribution of profits.

The above is the detailed content of Calculate Pro Rata Share Effortlessly with 2 Easy Methods. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to Use Parentheses, Square Brackets, and Curly Braces in Microsoft Excel

Jun 19, 2025 am 03:03 AM

How to Use Parentheses, Square Brackets, and Curly Braces in Microsoft Excel

Jun 19, 2025 am 03:03 AM

Quick Links Parentheses: Controlling the Order of Opera

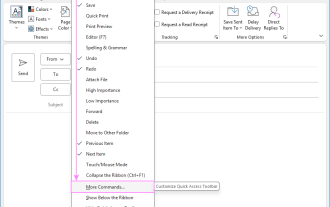

Outlook Quick Access Toolbar: customize, move, hide and show

Jun 18, 2025 am 11:01 AM

Outlook Quick Access Toolbar: customize, move, hide and show

Jun 18, 2025 am 11:01 AM

This guide will walk you through how to customize, move, hide, and show the Quick Access Toolbar, helping you shape your Outlook workspace to fit your daily routine and preferences. The Quick Access Toolbar in Microsoft Outlook is a usefu

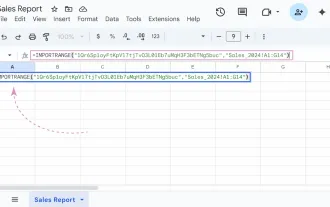

Google Sheets IMPORTRANGE: The Complete Guide

Jun 18, 2025 am 09:54 AM

Google Sheets IMPORTRANGE: The Complete Guide

Jun 18, 2025 am 09:54 AM

Ever played the "just one quick copy-paste" game with Google Sheets... and lost an hour of your life? What starts as a simple data transfer quickly snowballs into a nightmare when working with dynamic information. Those "quick fixes&qu

6 Cool Right-Click Tricks in Microsoft Excel

Jun 24, 2025 am 12:55 AM

6 Cool Right-Click Tricks in Microsoft Excel

Jun 24, 2025 am 12:55 AM

Quick Links Copy, Move, and Link Cell Elements

Don't Ignore the Power of F9 in Microsoft Excel

Jun 21, 2025 am 06:23 AM

Don't Ignore the Power of F9 in Microsoft Excel

Jun 21, 2025 am 06:23 AM

Quick LinksRecalculating Formulas in Manual Calculation ModeDebugging Complex FormulasMinimizing the Excel WindowMicrosoft Excel has so many keyboard shortcuts that it can sometimes be difficult to remember the most useful. One of the most overlooked

Prove Your Real-World Microsoft Excel Skills With the How-To Geek Test (Advanced)

Jun 17, 2025 pm 02:44 PM

Prove Your Real-World Microsoft Excel Skills With the How-To Geek Test (Advanced)

Jun 17, 2025 pm 02:44 PM

Whether you've recently taken a Microsoft Excel course or you want to verify that your knowledge of the program is current, try out the How-To Geek Advanced Excel Test and find out how well you do!This is the third in a three-part series. The first i

How to recover unsaved Word document

Jun 27, 2025 am 11:36 AM

How to recover unsaved Word document

Jun 27, 2025 am 11:36 AM

1. Check the automatic recovery folder, open "Recover Unsaved Documents" in Word or enter the C:\Users\Users\Username\AppData\Roaming\Microsoft\Word path to find the .asd ending file; 2. Find temporary files or use OneDrive historical version, enter ~$ file name.docx in the original directory to see if it exists or log in to OneDrive to view the version history; 3. Use Windows' "Previous Versions" function or third-party tools such as Recuva and EaseUS to scan and restore and completely delete files. The above methods can improve the recovery success rate, but you need to operate as soon as possible and avoid writing new data. Automatic saving, regular saving or cloud use should be enabled

5 New Microsoft Excel Features to Try in July 2025

Jul 02, 2025 am 03:02 AM

5 New Microsoft Excel Features to Try in July 2025

Jul 02, 2025 am 03:02 AM

Quick Links Let Copilot Determine Which Table to Manipu