The Internal Rate of Return (IRR) is a vital metric for evaluating the profitability of investments over time. It calculates the interest rate at which the net present value of cash inflows and outflows equals zero, effectively gauging the expected annual rate of return on an investment. Utilizing an IRR calculator in Microsoft Excel is a powerful tool for financial analysis, facilitating efficient, data-driven investment decisions.

Key Takeaways:

- IRR calculates the annualized rate of return for an investment, offering a percentage that reflects its profitability. It aids in determining if an investment is likely to generate positive returns.

- Computing IRR is essential for informed investment decisions, as it reveals potential profit and directs investors towards financially viable opportunities.

- Excel's IRR and XIRR functions are crucial for managing regular and irregular cash flows, respectively. IRR is suited for periodic cash flows, whereas XIRR is used for cash flows occurring at irregular intervals.

- Common errors such as #NUM! and #VALUE! can be resolved by ensuring the presence of at least one negative and one positive cash flow, and by checking that all input values are numeric and correctly formatted.

- For investments with irregular cash flows, the XIRR function provides a more precise rate of return by considering the exact timing of each cash flow, offering a detailed view of investment performance.

Table of Contents

Introduction to IRR in Excel

Defining the Internal Rate of Return (IRR)

The Internal Rate of Return, or IRR, is a key measure for assessing the profitability of investments where a series of cash flows is anticipated over time. It acts like a financial investigator that uncovers the hidden return on your investment by stating, "This is the interest rate required for your investment's cash inflows and outflows to balance out."

Importance of Calculating IRR for Investment Decisions

Calculating IRR is crucial for making astute investment decisions as it displays the potential profit an investment will yield in percentage terms. It's akin to a foresight tool that helps predict the financial efficacy of your investments, guiding you to make data-driven decisions that align with your financial objectives.

Setting Up Your Excel Workspace for IRR Calculator

Organizing Cash Flow Data

To begin using IRR in Excel, it's important to arrange your cash flows systematically. Start with your initial investment as a negative value, indicating cash outflow. Then, sequentially list the anticipated inflows. This setup ensures a seamless process through the calculations, reducing potential errors later on.

The Necessary Excel Tools for IRR Computation

Your toolkit for calculating IRR in Excel includes the IRR and XIRR functions. While IRR is designed for regular, periodic cash flows, XIRR excels when cash flows occur at unpredictable intervals—think varying amounts at different times.

Step-by-Step Guide to Using the IRR Function

Inputting Cash Flows into the Function

When entering cash flows into Excel's IRR function, include both positive and negative values. Begin with your initial investment, followed by the expected returns.

The process is straightforward:

Select the cell, type "=IRR(", then drag over the cash flow cells, and press enter. Your IRR will appear, ready for analysis.

INTERPRETATION: An Internal Rate of Return (IRR) of 14% indicates a projected annual return on investment. It suggests the investment exceeds its cost of capital, making it financially favorable. In decision-making, investments with IRRs surpassing 14% are typically preferred for their potential profitability.

Troubleshooting Common Errors

Encountering errors after entering your cash flows? Don't worry—they're often solvable.

- For

#NUM!errors, ensure there's at least one negative (investment) and one positive (return) value. The Initial Investment amount must be negative to avoid this error.

For #VALUE! errors, confirm that all inputs are numeric and not text or empty cells. The guess cell should also contain a numeric value, not text.

Advanced IRR Calculation Techniques

Working with Non-Periodic Cash Flows using XIRR

If your cash flows occur at irregular intervals, Excel's XIRR function is your solution. It adeptly handles cash flows with varying timings.

STEP 1: Set up two columns: one for the amounts and one for the dates.

STEP 2: Use the XIRR formula "=XIRR(values, dates)" to calculate the true rate of return.

Practical Examples of IRR Calculations in Excel

Simple Scenario: Calculating IRR for Annual Cash Flows

Consider a straightforward case: an investment with consistent annual cash inflows. List the yearly cash flow in Excel, starting with the initial outlay at year zero. Then, apply the =IRR() function, select your cash flow range, and press enter. Excel will calculate the IRR, presenting the annualized expected return.

STEP 1: Enter the cash flow data into columns A and B.

STEP 2: In cell E2, type "=IRR(B2:B7)" where column B represents the range of cash flows and press Enter. Excel will calculate the IRR, which in this case is approximately 10.87%.

INTERPRETATION: The calculated IRR of approximately 10.87% suggests that the investment's internal rate of return is the annualized rate at which the net present value (NPV) of the cash flows equals zero. In simpler terms, it represents the expected annualized return of the investment over its lifespan.

Complex Scenario: IRR for Irregular Intervals

For more challenging scenarios where cash flows occur at random intervals, the XIRR function is essential. List your cash flows along with their respective dates in Excel, regardless of their irregularity. Use the XIRR formula to calculate the more complex IRR, accounting for the actual timing of each cash flow.

STEP 1: Enter the cash flow data in columns A and B, with dates in column A and cash flows in column B.

STEP 2: In a cell, type "=XIRR(B2:B7, A2:A7)" where column B represents the range of cash flows and column A represents the range of dates & press Enter. Excel will calculate the XIRR, which in this case might be approximately 18.13%.

INTERPRETATION: The calculated XIRR of approximately 11.56% indicates the annualized rate of return considering the actual dates of each cash flow. It accounts for the irregular timing of cash flows, providing a more accurate measure of the investment's performance compared to traditional IRR calculations.

Tips for Accurate and Efficient IRR Computations

Understanding and Using the ‘Guess’ Parameter

Sometimes, Excel's IRR function requires a starting point to find the answer. This is where the ‘Guess’ parameter comes in. If you don't provide a guess, Excel defaults to 10%, which often works well. However, in more complex cash flow scenarios or when multiple rates of return exist, adjusting the ‘Guess’ can help Excel find the correct IRR more efficiently.

Although the guess usually doesn't affect the result, it's a useful tool to help Excel locate the rate more quickly, especially in scenarios with multiple IRR outcomes. The closer your guess is to the actual IRR, the faster Excel will find the correct answer.

Interpreting the Results of Your IRR Calculation

What Does a Particular IRR Percentage Indicate?

A specific IRR percentage decodes the financial potential of an investment. An IRR exceeding the hurdle rate indicates an investment likely to yield a higher return than the minimum expected. It's a signal from the financial world to proceed with the investment. On the other hand, an IRR below the baseline suggests the investment might not be as lucrative as desired.

- Positive IRR: It indicates that the investment generates returns exceeding the initial investment, suggesting profitability and attractiveness. Higher IRR values typically signify higher returns and lower investment risk.

- Negative IRR: It signifies that the investment yields returns lower than the initial outlay, implying potential losses and often indicating an unprofitable venture. Negative IRR values suggest caution, as they may indicate that the investment fails to meet its cost of capital or faces significant financial hurdles.

- Zero IRR: It implies that the investment's cash flows exactly offset the initial outlay. While rare, it suggests that the project neither generates profits nor incurs losses. This scenario may occur in break-even projects where the returns match the costs. Zero IRR values require careful assessment to determine the project's viability and potential impacts on overall financial objectives.

Limitations of IRR and How to Address Them

While IRR is a popular metric for assessing investment attractiveness, it has its limitations. Its assumption that you can reinvest at the same rate as the IRR can be overly optimistic, and it focuses solely on percentages, neglecting absolute dollar values. To mitigate these limitations, complement IRR with metrics like NPV or MIRR, which consider actual dollar returns and more realistic reinvestment rates. It's like seeking a second financial opinion—a prudent step before committing your funds.

Additional Excel Functions to Supplement IRR Analysis

Leveraging NPV for a Holistic View

To fully understand an investment's potential, use the Net Present Value (NPV). NPV complements IRR by factoring in the magnitude and timing of each cash flow, not just the break-even rate. It's like switching from a telescope to a microscope; you're now examining the investment's granular safety, able to see the actual dollar benefit over time when considering your chosen discount rate.

INTERPRETATIONS:

- An IRR of 23.17% indicates the investment's annualized rate of return, suggesting strong profitability and potential for high returns relative to the initial investment.

- The NPV of $3,582,131.80 reflects the present value of all cash flows discounted at a specified rate (usually the cost of capital). Positive NPV suggests the investment adds value, exceeding its cost. Together, they imply the investment is financially lucrative, with returns significantly outweighing costs, making it an attractive opportunity for investment.

Comparing IRR with Other Financial Metrics

While IRR provides a snapshot of your investment's efficiency, the financial landscape offers other metrics to consider. Balance the narrative by comparing IRR with metrics like NPV for net gains, Payback Period for break-even analysis, and Profitability Index to weigh the value created per dollar invested. This ensemble allows you to gain a more comprehensive, multi-dimensional view of your investment's performance, much like a balanced diet is healthier than focusing on one food group alone.

Cross-referencing IRR with other indicators ensures you're not overlooking a critical part of the financial puzzle, giving you the confidence to make decisions with a comprehensive financial perspective.

FAQs

How to do IRR calculation in Excel?

To calculate IRR in Excel, organize the relevant cash flow values in a single column. Then, use the IRR function by typing =IRR( and selecting your cash flow range. Excel will output the internal rate of return for that series of cash flows.

Can IRR Be Calculated Manually Without Excel?

Yes, IRR can be calculated manually, but it involves solving a complex polynomial equation where the net present value equals zero. Often, trial-and-error is used to approximate the rate, making Excel a much-preferred shortcut for most.

How Do I Handle #NUM! Errors When Computing IRR?

When facing #NUM! errors while computing IRR in Excel, ensure there's at least one positive and one negative cash flow. If still unresolved, try setting an initial ‘Guess’ value in the IRR formula, or review the cash flows for payment timing accuracy.

What Is the Difference Between IRR and XIRR Functions?

The difference lies in timing: IRR assumes equal interval cash flows, while XIRR is designed for cash flows that occur at irregular intervals. XIRR requires specific dates for each cash flow, providing a more precise rate of return for uneven investment schedules.

How Can I Calculate Monthly IRR in Excel?

To calculate monthly IRR in Excel, gather your monthly cash flows. Use the XIRR function, =XIRR(values, dates), inputting your cash flows and corresponding dates. Excel will deliver the monthly internal rate of return adjusted for the timing of each cash flow.

The above is the detailed content of IRR Calculator in Excel – Step by Step Guide. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to Use Parentheses, Square Brackets, and Curly Braces in Microsoft Excel

Jun 19, 2025 am 03:03 AM

How to Use Parentheses, Square Brackets, and Curly Braces in Microsoft Excel

Jun 19, 2025 am 03:03 AM

Quick Links Parentheses: Controlling the Order of Opera

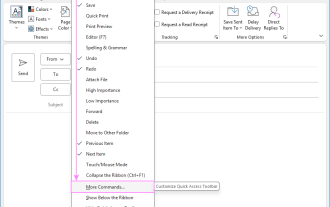

Outlook Quick Access Toolbar: customize, move, hide and show

Jun 18, 2025 am 11:01 AM

Outlook Quick Access Toolbar: customize, move, hide and show

Jun 18, 2025 am 11:01 AM

This guide will walk you through how to customize, move, hide, and show the Quick Access Toolbar, helping you shape your Outlook workspace to fit your daily routine and preferences. The Quick Access Toolbar in Microsoft Outlook is a usefu

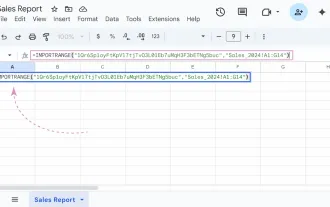

Google Sheets IMPORTRANGE: The Complete Guide

Jun 18, 2025 am 09:54 AM

Google Sheets IMPORTRANGE: The Complete Guide

Jun 18, 2025 am 09:54 AM

Ever played the "just one quick copy-paste" game with Google Sheets... and lost an hour of your life? What starts as a simple data transfer quickly snowballs into a nightmare when working with dynamic information. Those "quick fixes&qu

Don't Ignore the Power of F9 in Microsoft Excel

Jun 21, 2025 am 06:23 AM

Don't Ignore the Power of F9 in Microsoft Excel

Jun 21, 2025 am 06:23 AM

Quick LinksRecalculating Formulas in Manual Calculation ModeDebugging Complex FormulasMinimizing the Excel WindowMicrosoft Excel has so many keyboard shortcuts that it can sometimes be difficult to remember the most useful. One of the most overlooked

6 Cool Right-Click Tricks in Microsoft Excel

Jun 24, 2025 am 12:55 AM

6 Cool Right-Click Tricks in Microsoft Excel

Jun 24, 2025 am 12:55 AM

Quick Links Copy, Move, and Link Cell Elements

Prove Your Real-World Microsoft Excel Skills With the How-To Geek Test (Advanced)

Jun 17, 2025 pm 02:44 PM

Prove Your Real-World Microsoft Excel Skills With the How-To Geek Test (Advanced)

Jun 17, 2025 pm 02:44 PM

Whether you've recently taken a Microsoft Excel course or you want to verify that your knowledge of the program is current, try out the How-To Geek Advanced Excel Test and find out how well you do!This is the third in a three-part series. The first i

How to recover unsaved Word document

Jun 27, 2025 am 11:36 AM

How to recover unsaved Word document

Jun 27, 2025 am 11:36 AM

1. Check the automatic recovery folder, open "Recover Unsaved Documents" in Word or enter the C:\Users\Users\Username\AppData\Roaming\Microsoft\Word path to find the .asd ending file; 2. Find temporary files or use OneDrive historical version, enter ~$ file name.docx in the original directory to see if it exists or log in to OneDrive to view the version history; 3. Use Windows' "Previous Versions" function or third-party tools such as Recuva and EaseUS to scan and restore and completely delete files. The above methods can improve the recovery success rate, but you need to operate as soon as possible and avoid writing new data. Automatic saving, regular saving or cloud use should be enabled

5 New Microsoft Excel Features to Try in July 2025

Jul 02, 2025 am 03:02 AM

5 New Microsoft Excel Features to Try in July 2025

Jul 02, 2025 am 03:02 AM

Quick Links Let Copilot Determine Which Table to Manipu