Calculation of compound interest can be achieved in Excel through FV functions or manual formulas. 1. Prepare the data structure, including principal, annual interest rate, compound interest frequency and time; 2. Use the FV function, enter the interest rate for each period (annual interest rate ÷ compound interest times), the total number of periods (years × compound interest times), the amount of payment per period is 0, the present value is the principal and add a negative sign; 3. Manually write the multiplication formula: principal × (1 interest rate)^ years, which is applicable to compound interest by year; 4. If compound interest is compounded by month, then divide the annual interest rate by 12, and multiply by 12, the formula becomes principal × (1 annual interest rate/12)^ (years × 12), thereby increasing the final return.

Calculating compound interest is actually quite simple in Excel. The key is to figure out how to use the formula. Compound interest is not like single interest only counting the interest on the principal. It will also add the interest generated before and continue to generate interest, so the profit will significantly increase in the long run. In Excel, we can use a basic formula to quickly calculate the results.

Basic formula: FV = P × (1 r)^n

- P is the principal

- r is the interest rate per issue (such as annual interest rate or monthly interest rate)

- n is the total number of periods (such as years or months)

Just fill in these parameters into the Excel cell and enter the formula to automatically calculate it.

1. Prepare the data structure

First think about what compound interest situation you are calculating, such as compound interest by year, monthly or quarterly. Then set a few columns in Excel:

- Principal

- Annual Rate

- Compound interest frequency (such as once a year, 4 times a quarter, etc.)

- Time (years)

For example:

| principal | Annual interest rate | Compound interest times per year | Years |

|---|---|---|---|

| 10000 | 5% | 1 | 5 |

After sorting it out, you can apply the formula next.

2. Use FV function to calculate directly

Excel has a ready-made financial function FV() , which is specially used to calculate future value, including compound interest. Its basic writing is:

=FV(rate, nper, pmt, [pv], [type])

The parameters we mainly use are:

-

rate: interest rate per issue (annual interest rate ÷ compound interest times) -

nper: Total number of periods (years × compound interest times) -

pmt: The amount paid for each period is, if you don’t add money, fill in 0 -

pv: the present value, that is, the principal, and the negative sign is added before it to indicate expenditure

So if the above example is to be calculated, the formula is:

=FV(5%/1, 5*1, 0, -10000)

This will result in the total amount of principal and interest in five years.

3. Manual multiplication formula can be done

If you don't want to use FV functions, you can also use the most primitive method:

= principal*(1 interest rate)^ years

For example, the above example can be written as:

=10000*(1 5%)^5

This method is suitable for compound interest once a year, and it is more intuitive to operate, but it is slightly less flexible.

4. What should I do if I have monthly compound interest?

What many people are prone to mistake is the "compound interest cycle". For example, if the annual interest rate is also 5%, if it is compounded on a monthly basis, then the annual interest rate must be divided by 12 and the number of years is multiplied by 12.

So the formula becomes:

=FV(5%/12, 5*12, 0, -10000)

Or write manually:

=10000*(1 5%/12)^(5*12)

At this time, you will find that the final amount is a little higher than the compound interest per year, which is the impact of the compound interest frequency.

Basically that's it. Excel does not require too complicated steps to calculate compound interest. Just match the parameters and formulas to get the results quickly. Different compound interest methods will affect the final profit, so when using it, don’t forget to adjust the parameters in the formula according to the actual situation.

The above is the detailed content of how to calculate compound interest in excel. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to Use Parentheses, Square Brackets, and Curly Braces in Microsoft Excel

Jun 19, 2025 am 03:03 AM

How to Use Parentheses, Square Brackets, and Curly Braces in Microsoft Excel

Jun 19, 2025 am 03:03 AM

Quick Links Parentheses: Controlling the Order of Opera

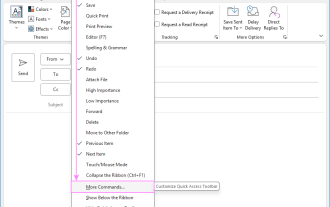

Outlook Quick Access Toolbar: customize, move, hide and show

Jun 18, 2025 am 11:01 AM

Outlook Quick Access Toolbar: customize, move, hide and show

Jun 18, 2025 am 11:01 AM

This guide will walk you through how to customize, move, hide, and show the Quick Access Toolbar, helping you shape your Outlook workspace to fit your daily routine and preferences. The Quick Access Toolbar in Microsoft Outlook is a usefu

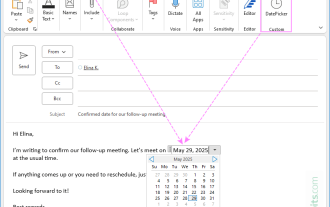

How to insert date picker in Outlook emails and templates

Jun 13, 2025 am 11:02 AM

How to insert date picker in Outlook emails and templates

Jun 13, 2025 am 11:02 AM

Want to insert dates quickly in Outlook? Whether you're composing a one-off email, meeting invite, or reusable template, this guide shows you how to add a clickable date picker that saves you time. Adding a calendar popup to Outlook email

Prove Your Real-World Microsoft Excel Skills With the How-To Geek Test (Intermediate)

Jun 14, 2025 am 03:02 AM

Prove Your Real-World Microsoft Excel Skills With the How-To Geek Test (Intermediate)

Jun 14, 2025 am 03:02 AM

Whether you've secured a data-focused job promotion or recently picked up some new Microsoft Excel techniques, challenge yourself with the How-To Geek Intermediate Excel Test to evaluate your proficiency!This is the second in a three-part series. The

How to Delete Rows from a Filtered Range Without Crashing Excel

Jun 14, 2025 am 12:53 AM

How to Delete Rows from a Filtered Range Without Crashing Excel

Jun 14, 2025 am 12:53 AM

Quick LinksWhy Deleting Filtered Rows Crashes ExcelSort the Data First to Prevent Excel From CrashingRemoving rows from a large filtered range in Microsoft Excel can be time-consuming, cause the program to temporarily become unresponsive, or even lea

How to Switch to Dark Mode in Microsoft Excel

Jun 13, 2025 am 03:04 AM

How to Switch to Dark Mode in Microsoft Excel

Jun 13, 2025 am 03:04 AM

More and more users are enabling dark mode on their devices, particularly in apps like Excel that feature a lot of white elements. If your eyes are sensitive to bright screens, you spend long hours working in Excel, or you often work after dark, swit

Microsoft Excel Essential Skills Test

Jun 12, 2025 pm 12:01 PM

Microsoft Excel Essential Skills Test

Jun 12, 2025 pm 12:01 PM

Whether you've landed a job interview for a role that requires basic Microsoft Excel skills or you're looking to solve a real-world problem, take the How-To Geek Beginner Excel Test to verify that you understand the fundamentals of this popular sprea

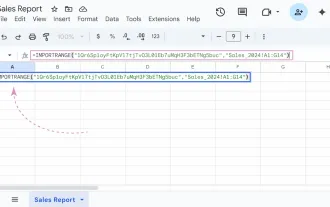

Google Sheets IMPORTRANGE: The Complete Guide

Jun 18, 2025 am 09:54 AM

Google Sheets IMPORTRANGE: The Complete Guide

Jun 18, 2025 am 09:54 AM

Ever played the "just one quick copy-paste" game with Google Sheets... and lost an hour of your life? What starts as a simple data transfer quickly snowballs into a nightmare when working with dynamic information. Those "quick fixes&qu